Since moving into Boulder Commons in late 2017, Rocky Mountain Institute’s (RMI’s) net-zero energy (NZE) multi-tenant Class A office in Boulder, Colorado (pictured above), RMI has been working to share lessons learned and increase adoption of advanced green and net-zero energy leases. While innovative efforts such as RMI’s have been raising the ceiling for green leases, there is another big opportunity to raise the floor for the millions of square feet of leased space across the country.

In leased office spaces in the United States alone, green leases have the potential to unlock $1.7 billion to $3.3 billion in annual cost savings. While basic green lease components have penetrated a growing portion of the Class A office market, there is still a need to scale the practice and reach under-served Class B and C offices, as well as non-office commercial spaces. Considering only about 18 percent of commercial buildings are offices, and only 16 percent of offices are Class A (approximated using building age), there is both a significant need and opportunity to incentivize efficiency upgrades through green leasing in more leased buildings to reap more savings and higher performance.

These sectors can be more difficult to reach for many reasons including:

- Less Specialty: Landlords tend to be smaller companies, which results in “jack of all trades” positions. This leads to less expertise around sustainability and less time available to learn about sustainability best practices such as green leases. Since small commercial buildings in the U.S. consume 47 percent of all primary energy in the building sector, these companies need greater attention and education on best practices to capture more utility savings and efficiency benefits.

- Lack of Motivation: Class B and C offices don’t typically attract as well-resourced and sophisticated tenants as Class A offices. Tenants in Class A offices might demand more sustainable buildings to meet their corporate sustainability goals, while tenants in the smaller Class B and C offices may be more cost-driven. If tenants aren’t demanding it, landlords typically won’t spend the time and effort required to do something new.

- Transaction Costs: These landlords might not have access to as much capital as the larger, high-profile landlords of Class A buildings, so they may struggle to justify the up-front cost of efficiency projects, even if such projects provide a good return on investment. Greater use of innovative financing tools can help alleviate this, but more action is required to educate the market on these tools and connect real estate decision makers with the best options.

Despite these challenges, there are examples of smaller Class B and C buildings for which green leases have been successfully implemented, highlighted by IMT and the Council of Smaller Enterprise’s (COSE) Making Efficiency Work for You: A Guide for Empowering Landlords and Tenants to Collaborate on Saving Energy & Resources.

One of the green leasing case studies in the resource highlights the NEO Realty Group. To overcome split-incentive barriers, NEO Realty agreed to cover all of a tenant’s upgrade costs with an expected return on investment of 15 percent at the end of the lease term, in addition to an overall reduction in energy expenses. As a result of upgrades, the tenant—an American Cancer Society Discovery Shop based in Northeast Ohio—reduced its lighting load by 70 percent and the store’s repair expenses will be reduced due to the new, longer-lasting equipment. This green lease transaction demonstrates that anyone in any location can achieve energy efficiency goals for both landlord and tenant stakeholders.

One of the green leasing case studies in the resource highlights the NEO Realty Group. To overcome split-incentive barriers, NEO Realty agreed to cover all of a tenant’s upgrade costs with an expected return on investment of 15 percent at the end of the lease term, in addition to an overall reduction in energy expenses. As a result of upgrades, the tenant—an American Cancer Society Discovery Shop based in Northeast Ohio—reduced its lighting load by 70 percent and the store’s repair expenses will be reduced due to the new, longer-lasting equipment. This green lease transaction demonstrates that anyone in any location can achieve energy efficiency goals for both landlord and tenant stakeholders.

NEO Realty is one of the only landlords of Class B and C buildings to be named a Green Lease Leader, which highlights the ongoing need to accelerate engagement with this sector, but also demonstrates success stories for what can be achieved.

Green Lease Leaders,a national recognition program that was launched by IMT and the U.S. Department of Energy’s Better Buildings Alliance in 2014, recently announced the 2018 cohort of Green Lease Leaders, putting a spotlight on firms and organizations such as RMI that push the envelope on green leasing best practices and innovation. To date, Green Lease Leaders represent more than 1.8 billion square feet of space, with further growth anticipated in 2019. IMT is working to engage more small business landlords and tenants through its Small Business Energy Initiative to get them to a place where they can apply for recognition.

What can the industry do to help push green leases forward in these hard-to-reach sectors?

While leading holders of Class B and C offices and other commercial buildings are beginning to integrate basic energy efficiency and sustainability language into their leases, there are actions nonprofits or local governments can take to help further increase adoption including:

-

-

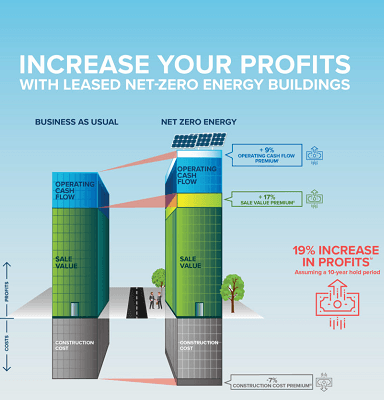

Click to view full infographic Develop a business case: RMI and IMT have begun creating transparent and bulletproof business cases for green leasing for building owners and tenants in order to motivate action. While IMT performed an analysis summarizing the potential energy savings available in offices through green leases, similar green lease impact potential in other sectors would be helpful in moving the market forward. RMI’s NZE Leasing Best Practice Guide also summarizes the business case for more-efficient buildings, which includes tenant retention, rent premiums, and high resale value for landlords, and higher employee productivity and retention for tenants.

- Create More Education and Collaboration Opportunities: Class B and C owners and their tenants need to be equipped with strategies to work alongside one another to green their lease and make high-performance tenant spaces. How can each party start the conversation? How can they work together to make green leasing as seamless as possible? One way IMT is addressing this is through its Small Business Energy Initiative, which provides energy efficiency education paired with tailored resources to local chambers of commerce and similar small business associations, as well as their member businesses. These organizations are trusted thought leaders and primary connectors to local small businesses—many of which operate in the important but hard-to-reach small- and medium-size buildings sector (typically Class B and C buildings). As such, they have the power to effectively work with their small business members as well as key energy efficiency influencers at utilities, banks, and local governments to ignite greater interest, demand, and investment in building efficiency and sustainability. IMT’s recent Small Business Energy Initiative Action Guide provides local chambers and similar organizations with tools, resources, and best practices to energize and inform efforts to establish or improve an energy efficiency program.

- Engage with allies to spread the word: Local governments and trade organizations can be trusted advisors to holders of class B and C commercial real estate, convene green leasing experts in the field, and facilitate business-to-business discussion. Denver is one city leading the charge with its Lease for Efficiency Challenge, in which tenants pledge to ask their landlords about building energy performance to start the dialogue around building energy efficiency. Additionally, Denver recently released an RFP for a firm to develop a program that will make Energy Smart Leasing the standard practice in the city in three years. This plan includes trainings, tools, engagement and recognition, and development of case studies. This will hopefully result in higher market penetration of green leases. RMI recently completed a similar outreach campaign for the city of Boulder to increase adoption of advanced green leases. Cities are powerful stakeholders to help move industry forward.

- Share sample green lease language: Making the use of green lease language common practice requires making it incredibly easy to copy and paste. Resources such as Making Efficiency Work for You, Green Lease Leaders Reference Guide, Sample Lease Language from the GSA, and NZE Lease Excerpts provide sample green lease language, which helps property managers incorporate green lease language without needing to craft the concepts with their lawyers. The basic components that should be included in any green lease include:

a. Cost recovery clause: Necessary in order to get a return on energy efficiency and renewable investments.

b. Energy-efficient tenant build-out: Ensures new tenants are installing efficient equipment when building out their spaces.

c. Building commissioning: Ensures the building is operating as intended and results in efficiency projects with low costs and good returns on investments.

d. Building energy disclosure: Ensures both tenants and landlords know how much energy the building is using. If efficiency upgrades take place, this is important to validate the energy savings and build the case for future efficiency projects. - Get help from the experts. Whether for a Class A office in the heart of New York City or an industrial building in Detroit, green leasing makes good business sense for both landlords and tenants, and is necessary to increase efficiency of leased buildings. If you are a tenant and desire to have sustainability and energy efficiency incorporated into your lease, start a dialogue with your landlord. If you’re a property manager and want to learn more about incorporating green leasing language into your lease, review the resources in this blog or contact IMT at alex.harry@imt.org or RMI at apetersen@rmi.org to get started! For other green lease guides, case studies, webinars, and more, visit greenleaselibrary.com.

-

Already implementing a green lease for your building or tenant space? Visit greenleaseleaders.com to assess your lease and see if you qualify to be recognized as a Green Lease Leader.

A version of this blog appears on the RMI Outlet.