As IMT and the Retail Industry Leaders Association (RILA) reach the third and final post of our blog series on energy efficiency financing for retailers, we take a look at specialized financing mechanisms that include Property Assessed Clean Energy (PACE), On-Bill Financing and Repayment (OBF/OBR), and Tax Increment Financing (TIF). Primers on these mechanisms and more can be found in our new Guide to External Financing for Energy Efficiency in Retail. Equipped with this guide and our energy efficiency finance calculator, facilities, operations, or sustainability managers should be able to determine the viability of various financing mechanisms to fund future energy projects within their portfolios.

Part One and Two of this series covered a lot of ground, particularly for large energy projects. However, specialized financing mechanisms are the best solution for energy efficiency projects ranging from a few thousand dollars to several hundred thousand dollars. Ultimately, these tools offer diversity—providing solutions for owned and leased space, small and large projects, and even the opportunity for retailers to participate in community development projects. Below, we take a look at: Property Assessed Clean Energy (PACE), On-Bill Financing and Repayment (OBF/OBR), and Tax Increment Financing (TIF).

Property Assessed Clean Energy

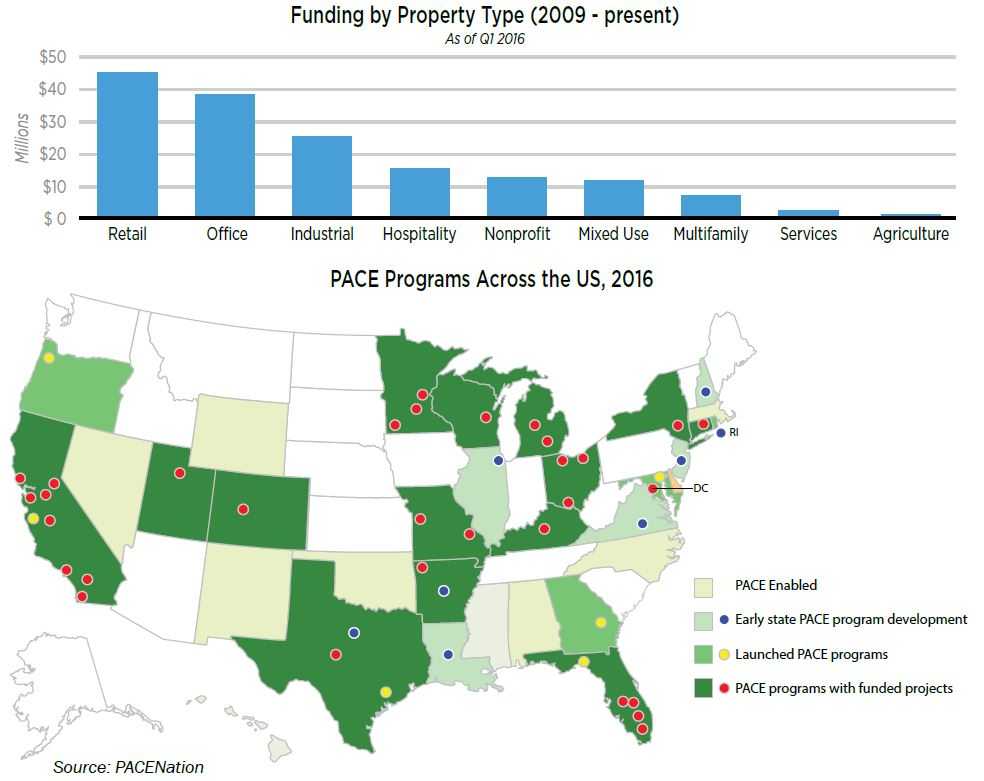

Property Assessed Clean Energy (PACE) programs allow local governments, state governments, or other interjurisdictional authorities, when approved by state law, to fund the upfront cost of energy improvements on commercial and residential properties. PACE legislation for commercial properties is available in 30 states and the District of Columbia.

Property owners repay their improvement costs over a set time period—typically 10-20 years—through property assessments, which are secured by the property itself and paid as an addition to the owners’ property tax bills. A PACE assessment is a debt of property, meaning the debt is tied to the property as opposed to the property owner, so the repayment obligation may transfer with property ownership depending upon state legislation. This eliminates a key disincentive to investing in energy improvements, as many property owners are hesitant to make energy efficiency upgrades if they don’t plan to stay in the property long enough for the resulting savings to cover the upfront costs.

The retail sector is the most active user of commercial PACE, closing on $45.7 million in financing to date. BrandsMart, a retailer based in Florida, worked with the clean energy financer Ygrene Works and Florida Green Energy Works to successfully arrange PACE deals in three of its stores since 2014. The deals ranged in size from $1.8 million to $3.1 million, for a total of $7.1 million financed. The latest deal, worth $3.1 million in BrandMart’s Miami Gardens store, is expected to generate $310,000 in savings annually. While these deals were quite large, it’s important to note that only 17% of commercial PACE deals are larger than $750,000. Smaller deals are more likely with 53% falling in the range of $75,000-$750,000 and 30% being worth less than $75,000. That said, many PACE programs set project size minimums in the $25,000-$50,000 range likely because it is time consuming to put in place for all parties including the borrower.

On-Bill Financing and Repayment

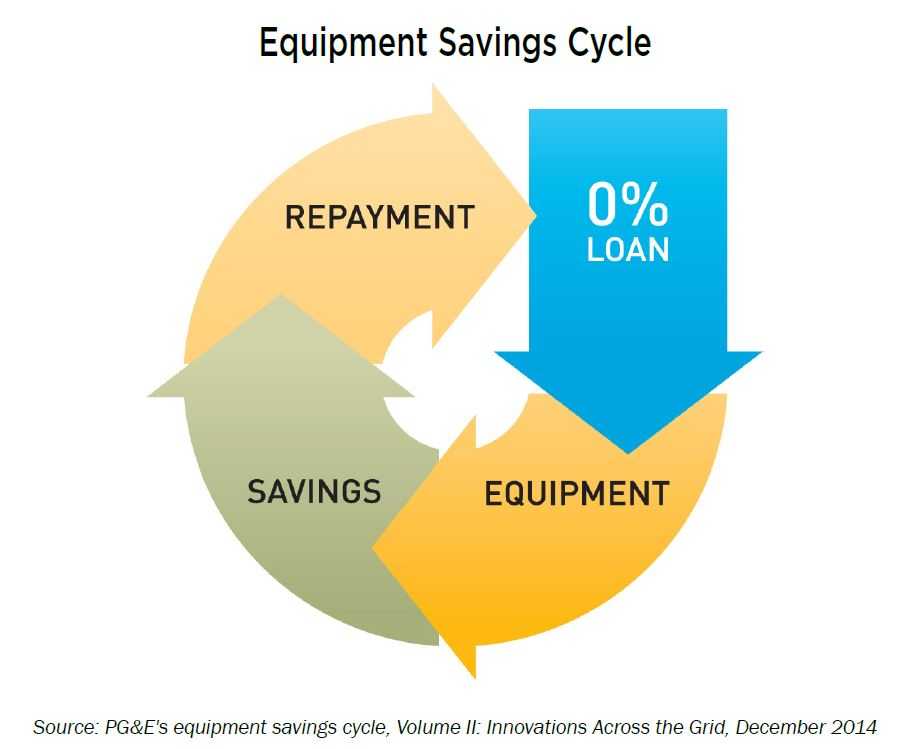

On-Bill Financing (OBF) and Repayment (OBR) are financing options whereby a utility or lender supplies capital to a utility customer to make energy efficiency improvements and is repaid through regular monthly loan payments on an existing utility bill. One benefit of these programs is the potential to serve a broad set of retailers, including those in both owned and leased spaces.

When funds are provided by the utility, the repayment structure is termed OBF. OBR is when a private financial institution extends loans to utility customers and relies on the utility’s bill presentment function for repayment. On-bill programs are only offered by a small number of utilities, and each program has its own terms and processes. Typical programs offer financing in the range of $5,000-$100,000, but larger deals have been done.

Several retailers in the food and grocery industry have utilized on-bill programs in recent years with favorable results. A grocer based in California qualified for a $100,000 zero-interest loan through PG&E and is saving over $20,000 per year. The company was able to use the program to add to its bottom line and now uses 42 percent less energy in its facility, enabling it to achieve a green business certification through The Bay Area Green Business Program. The facility will repay its loan in full in less than five years.

Tax Increment Financing

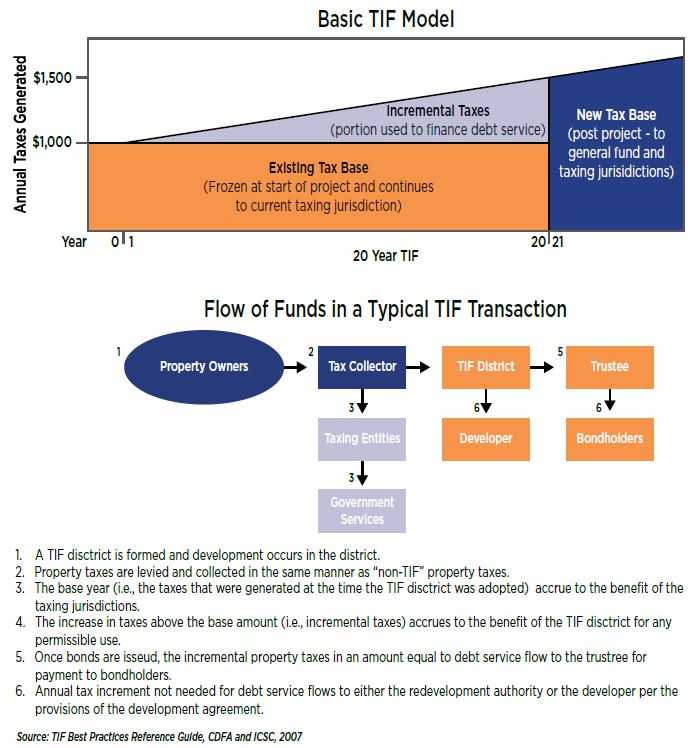

Tax Increment Financing (TIF) is a financing option that uses expected future gains in state or municipal property taxes from a development or redevelopment project to finance improvements that will create those gains. Used as a community development tool for decades, TIF is offered by jurisdictions to attract private capital to boost local economies and attract unique, innovative projects.

TIF is a great source of gap financing, which can increase the feasibility of projects. Gap financing is a secondary source of capital for a large project (a bank loan or mortgage is typically the primary source) that can be used to finance energy efficiency improvements. While TIF is occasionally used in retail, it is likely unavailable to most projects. However, retailers that are able to access TIF should take full advantage of it, as it can provide millions of dollars for projects and does not need to be repaid.

In 2003, the city of Millville, N.J., designated 821 acres as a TIF district. This designation spurred development including the Goodmill Shopping Center and a Target Retail Center. The Goodmill Shopping Center is a 500,000 square-foot facility whose tenants include ShopRite, Kohls, Starbucks, and others. A Target Retail Center, which occupies 125,000 square-feet of retail space, is connected with the Goodmill Shopping Center but under separate ownership. For more information on this deal, click here.

Specialized financing: Is it for you?

While specialized financing can be used for many different projects, options such as PACE and OBF/OBR are best for retailers looking to fund smaller energy projects. When a city, state, or public utility leverages their bonding authority to make specific financing available for companies, the cost of capital is almost always lower than it would be in an unregulated market. Therefore, retailers looking for strong returns will likely be attracted to specialized financing options. For those interested in large scalable projects, specialized financing is likely not for you and we direct your attention to other mechanisms included in our Guide to External Financing for Energy Efficiency in Retail.

For more information on retail energy efficiency financing, visit RILA’s website to download our new resources for free.