Just before the Paris Climate Conference (COP21) last December, the six largest U.S. banking institutions released a statement recognizing the need for policies to support investments in climate solutions: “Expanded deployment of capital is critical, and clear, stable and long-term policy frameworks are needed to accelerate and further scale investments.” Their declaration represented a big departure from the banking industry’s traditional anti-regulation stance and underscored the lending community’s growing recognition that investing in climate solutions is good for business.

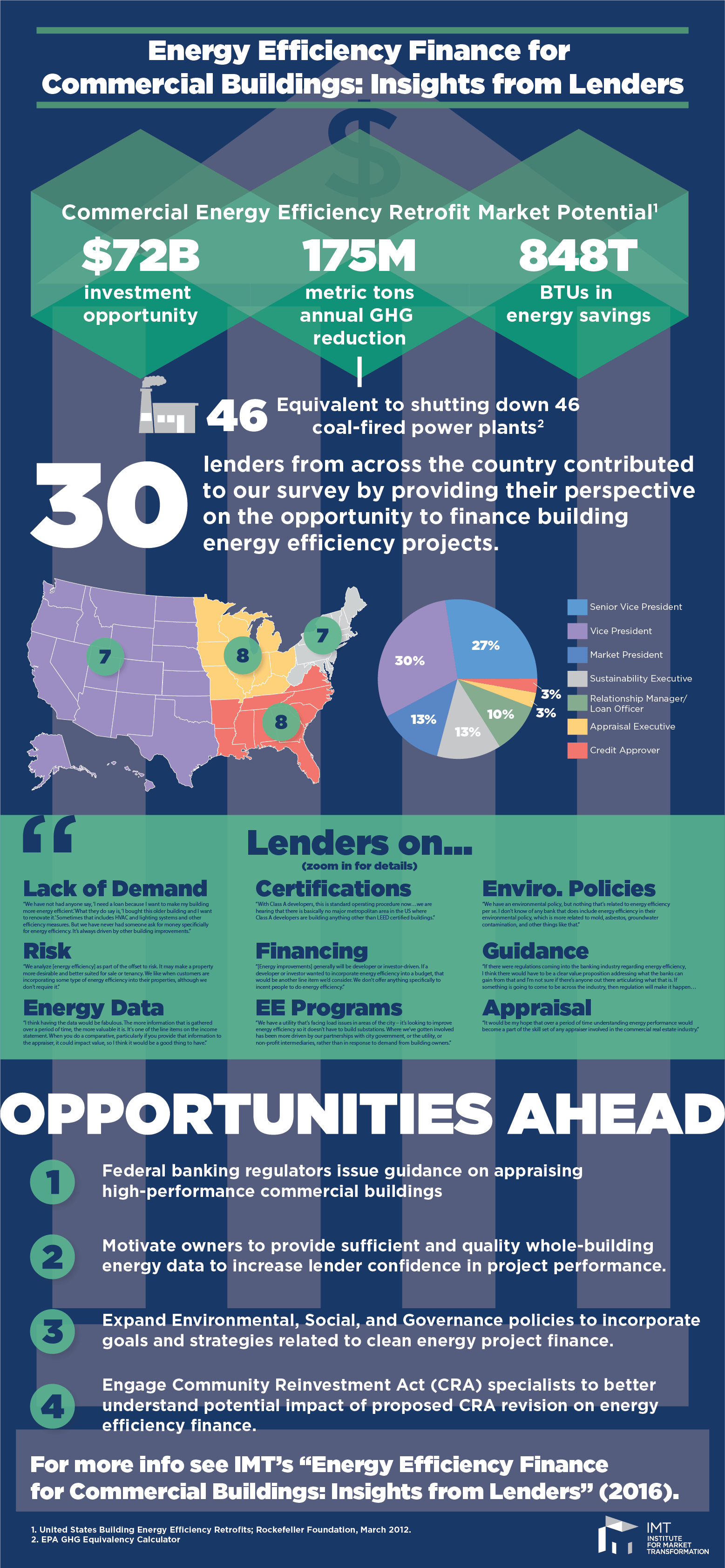

The announcement was also a positive signal to green building proponents, as commercial banks are major players in real estate finance and have a tremendous capability to increase investment in building energy efficiency. In fact, a 2012 report by The Rockefeller Foundation and Deutsche Bank Climate Change Advisors stated there is a $72 billion investment opportunity for commercial energy efficiency retrofits. However, as IMT’s new report, “Energy Efficiency Finance for Commercial Buildings: Insights from Lenders” illuminates, some hard work lies ahead to fully take advantage of this market opportunity.

To gain better insight on what’s needed, IMT interviewed 30 commercial lenders across the U.S. to hear their take on the market for building energy efficiency financing. We surveyed executive-level lenders with experience in commercial real estate who work for institutions ranging in size from large national banks to local Community Development Financial Institutions (CDFIs).

*Right click to view larger image or download the infographic here.

Through our survey we found that lenders across the board are not yet seeing sufficient demand for energy efficiency finance and therefore aren’t taking steps internally to incentivize better building energy performance. And if energy improvements are included in a proposed project seeking financing, they typically represent only a small slice of the construction or renovation pie—with things like flooring or countertops taking higher priority. So what can be done to stimulate greater demand for building energy efficiency?

In the near term, lenders can assume a leadership role by incorporating projected energy cost savings of proposed efficiency upgrades into their risk assessments—which they use to determine how much they will lend to a borrower. Of the 30 interviewed lenders, nine banks and three CDFIs thought it would be beneficial to incorporate building energy data, such as projected energy cost savings, into underwriting. Energy cost savings will increase an owner’s Net Operating Income (NOI), and this can encourage lenders to offer more favorable financing and thereby stimulate demand for building energy efficiency.

Interviewed lenders generally saw the value of incorporating building energy data into the appraisal process as well, and approximately half recognized the benefits of selecting appraisers with experience valuing high-performance buildings. The Appraisal Institute—the leading professional association of real estate appraisers—has taken many positive steps to facilitate the proper valuation of high-performance buildings. For example, in 2015 the organization released a Commercial Green and Energy Efficient Addendum, a resource that enables builders, developers, LEED consultants, and others (including appraisers) to document a building’s high-performance features and which an appraiser can then reference when making a determination of how much a property is worth. Nevertheless, most lenders still lack the incentive to change “business-as-usual” and adopt these green appraisal practices.

A property’s value is used as collateral for a commercial loan, so a higher valuation that incorporates high-performance building features means less collateral risk for the lender in the case of borrower default. As lenders are in the business of minimizing risk, they should be motivated to adopt green appraisal practices.

So what’s holding them back? Aside from the lending community being historically conservative in nature, the interviewed lenders cited “energy savings not materializing” as their greatest perceived risk for energy efficiency projects. Lenders currently do not have enough confidence in energy savings projections to push for this data to be incorporated into their underwriting and appraisal processes. That’s why efforts being made by groups like the Investor Confidence Project, which seeks to develop stakeholder confidence in energy project performance through standardization, are much needed.

There also needs to be a stronger effort on the part of building owners and managers, who are in a unique position to provide lenders with building energy data that may increase their willingness to lend. Unfortunately, many owners don’t provide this type of data to their lenders, who in turn are not asking for the information. This may change as more cities, counties, and states pass building energy benchmarking laws, causing more building owners to measure and share their energy use. For a deeper dive on the importance of having a proactive owner who provides energy data for lenders to both incorporate into their underwriting and reference when writing their appraisal scope of services, read IMT’s “Green Building and Property Value” guide.

Finally, a key challenge is the size of the commercial real estate lending industry: a monumental effort is needed to change its status quo. IMT’s survey probed “business as usual” in commercial real estate finance, and I encourage you to download the report and infographic for additional insights into how lenders view energy efficiency finance and the steps needed to encourage industry change. While there are certainly some innovative lending practices being undertaken to facilitate building energy efficiency, the bottom line is there’s much more work to be done.